Title: Exploring the Evolution of Big Data in Finance: A Look Back at the 2016 Rankings

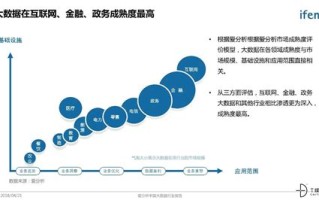

In 2016, the intersection of big data and finance was rapidly evolving, with institutions worldwide harnessing data analytics to gain insights, mitigate risks, and optimize decisionmaking processes. Several ranking reports offered valuable insights into the top players in this dynamic field. Let's delve into the 2016 rankings to understand the landscape of big data in finance during that time.

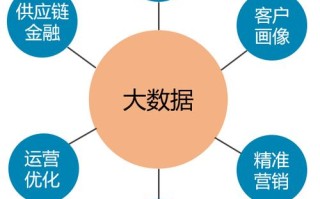

Introduction to Big Data in Finance

Big data revolutionized the financial sector by enabling institutions to analyze vast amounts of structured and unstructured data in realtime. This transformation facilitated better risk management, fraud detection, customer insights, and trading strategies.

Key Players in the 2016 Rankings

1.

IBM

: Renowned for its Watson Analytics platform, IBM dominated the big data landscape in finance. Its cognitive computing capabilities empowered financial institutions to analyze complex data sets and extract actionable insights swiftly.2.

Oracle

: Leveraging its expertise in database management, Oracle offered comprehensive big data solutions tailored to the finance industry. Its platforms facilitated data integration, predictive analytics, and risk modeling, empowering institutions to make informed decisions.3.

SAS

: With a strong focus on analytics and business intelligence, SAS emerged as a key player in the finance sector. Its suite of analytics tools enabled organizations to derive valuable insights from data, driving innovation and competitive advantage.4.

Teradata

: Specializing in data warehousing and analytics, Teradata provided scalable solutions to financial institutions grappling with massive data volumes. Its platforms facilitated advanced analytics, regulatory compliance, and customer segmentation.5.

Microsoft

: Harnessing the power of Azure cloud services and Power BI, Microsoft offered robust big data solutions to financial firms. Its cloudbased analytics tools empowered organizations to derive insights from data stored across various sources, enhancing agility and scalability.Trends Shaping Big Data in Finance

1.

Machine Learning and AI Integration

: In 2016, financial institutions increasingly embraced machine learning and artificial intelligence to automate processes, detect patterns, and personalize customer experiences.2.

Regulatory Compliance

: Stricter regulatory requirements prompted financial firms to invest in big data analytics for compliance monitoring, fraud detection, and risk assessment.3.

Cybersecurity

: As cyber threats proliferated, datadriven cybersecurity solutions gained prominence, helping financial institutions fortify their defenses and safeguard sensitive information.4.

CustomerCentric Strategies

: Big data empowered financial institutions to gain deeper insights into customer behavior and preferences, enabling personalized services, targeted marketing campaigns, and improved customer satisfaction.Challenges and Opportunities

While big data offered immense opportunities, financial institutions faced several challenges, including data privacy concerns, talent shortages, and legacy system integration issues. Overcoming these challenges required strategic investments in technology, talent development, and regulatory compliance frameworks.

Conclusion

The 2016 rankings shed light on the pivotal role of big data in transforming the finance industry. As institutions continued to leverage data analytics to drive innovation and competitiveness, the landscape evolved, with new players emerging and existing ones enhancing their offerings. By staying abreast of emerging trends and embracing technological advancements, financial firms could harness the full potential of big data to achieve sustainable growth and resilience in an increasingly digital world.

This retrospective analysis underscores the transformative impact of big data on finance in 2016 and serves as a foundation for understanding its continued evolution in subsequent years.

References

"2016 Big Data 100: 35 Coolest Data Management Vendors", CRN

"Gartner Magic Quadrant for Data Management Solutions for Analytics", Gartner, 2016

"The Forrester Wave™: Big Data Fabric, Q4 2016", Forrester

"World's 100 Most Innovative Companies", Forbes, 2016

标签: 大数据金融案例分析 大数据金融专业怎么样 大数据金融的内涵是什么 大数据金融和金融大数据区别

还木有评论哦,快来抢沙发吧~